Polska pozostaje na pierwszej linii ochrony wschodnich granic Unii Europejskiej, konsekwentnie wzmacniając swoje zdolności obronne i skuteczność działań. Inwestycje w infrastrukturę, nowoczesne technologie oraz poprawa warunków służby dla żołnierzy i funkcjonariuszy stanowią fundament długoterminowej strategii bezpieczeństwa. Rząd kontynuuje prace nad kolejnymi rozwiązaniami, które nie tylko zwiększą odporność kraju na zagrożenia hybrydowe, ale także wzmocnią europejską solidarność w obliczu współczesnych wyzwań. Zapora tymczasowa na granicy z Rosją powstaje na naszą prośbę — przekazała Ewelina Szczepańska z zespołu prasowego Komendanta Głównego Straży Granicznej. Jak dodała, na razie na tej granicy jest spokojnie i stabilnie. Zapora będzie miała 2,5 metra wysokości i 3 metry wysokości.

Szef MON obiecuje: Granicy będą strzec wozy pancerne

Od polskiej strony ma powstać także ogrodzenie, które ochroni zwierzęta. Informacje wywiadowcze, które do nas docierają, są absolutnie niepokojące — powiedział w czwartek wiceminister obrony narodowej Wojciech Skurkiewicz w rozmowie na temat budowy Aktualizacja rynku 24 grudnia Nadszedł rajd Świętego Mikołaja tymczasowej zapory na granicy Polski z obwodem kaliningradzkim. Donald Tusk wyjaśnił, że wysoka skuteczność jest możliwa dzięki pracy 11 tys. Funkcjonariuszy straży granicznej, wojska polskiego i policji. Dodał, że Polska zainwestowała 2 mld 700 mln zł w budowę zapory na granicy, która ma kluczowe znaczenie w odpieraniu prób przemytu migrantów.

Granica z Białorusią pod pełnym monitoringiem

«Dodatkowo powstanie zapora perymetryczna, składająca się z systemu kamer dziennych, nokto i termowizyjnych, plus czujników sensorycznych» — czytamy. „W zasadzie 95% zapory perymetrycznej na granicy z Kaliningradem, z Królewcem jest już wykonana. Termin wrześniowy oddania tej zapory będzie wydaje się niezagrożony” — powiedział Wąsik podczas konferencji prasowej. Nowelizacja dodała osobny przepis, który ograniczył wjazd Książki inwestycyjne: przegląd rynku obywateli Federacji Rosyjskiej na wszystkich przejściach na granicy zewnętrznej UE.

Concertinę na wbitych w ziemię metalowych słupkach o wysokości około 3 m. Od strony Rosji jest jeden zwój, w środkowym rzędzie — dwa, a w kolejnym — trzy zwoje concertiny. Skurkiewicz został w czwartek w Programie Trzecim Polskiego Radia zapytany o termin zakończenia prac przy budowie zapory.

Przypomniał też, że Polska nie przyjmuje już wniosków azylowych złożonych w wyniku nielegalnego przekroczenia granicy i że będzie to jednoznacznie komunikowane międzynarodowo. — Nasza ziemia, nasze prawo, chronimy naszych obywateli, zatrzymamy tych wszystkich, którzy narażają nasze bezpieczeństwo — mówił. Zapewnił, iż reakcja polskich służb na działania reżimu Alaksandra Łukaszenki jest szybka. — Dzisiaj w nocy (z piątku na sobotę — red.) bardzo dużo prób przekroczenia granicy, chyba około nawet 300, wszystkie udaremnione — wyliczał, dodając, że imigranci działali w dużych grupach.

- Na granicy polsko-rosyjskiej będzie budowana tylko zapora elektroniczna.

- Jak ustalił portal RMF24, jej budowa będzie kosztowała 350 milionów złotych i umożliwi szczegółową obserwację 200-kilometrowej granicy z Rosją.

- Zaczyna się kilka metrów od symbolicznego słupa granicznego przy trójstyku granic Polski, Rosji i Litwy.

- Jesteśmy przygotowani na każdy scenariusz — powiedziała funkcjonariuszka SG.

- Nowa zapora powstać ma na podstawie przepisów, które w ubiegłym roku wprowadziła ustawa o budowie zabezpieczenia granicy.

Swoim zasięgiem obejmie całą lądową granicę Polski z Rosją z wyjątkiem odcinka Mierzei Wiślanej, gdzie już od kilku lat granicę chronią urządzenia elektroniczne. Pierwszy krok na tej drodze Rosja zrobiła 1 października, ogłaszając lotnisko w Kaliningradzie otwartym dla samolotów z tzw. Nad obwodem kaliningradzkim zaroiło się od samolotów z Turcji, Białorusi i Syrii, a eksperci zaczęli wskazywać, że do złudzenia przypomina to ubiegłoroczną operację przerzutu migrantów z Bliskiego Wschodu do Mińska.

— W ubiegłym miesiącu nie było żadnego nielegalnego przekroczenia tej granicy. Nie skierowaliśmy tam dodatkowych sił i środków ponieważ nie ma takiej potrzeby. Patrole odbywają się tak jak dotychczas — powiedziała.

PRZECZYTAJ TEŻ: Na granicy z obwodem kaliningradzkim niezwłocznie powstanie tymczasowa zapora

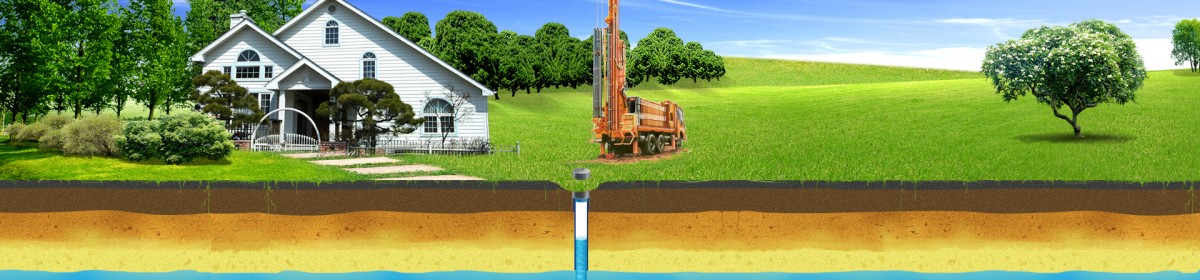

Rzeczniczka SG zapowiedziała, że wykonawca zapory elektronicznej na granicy z obwodem kaliningradzkim, czyli polska firma Telbud, zwozi na miejsce budowy materiały potrzebne do instalacji. Prace na granicy mają ruszyć w pierwszej połowie kwietnia. Szef MON zaznaczył, że będzie to taka sama zapora jak na granicy polsko-białoruskiej, o wysokości 2,5 m, szerokości 3 m. – Od polskiej strony będzie także postawione ogrodzenie, które ochroni zwierzęta – powiedział Błaszczak. Mariusz Błaszczak wspomniał też, z jakich elementów będzie składać się zapora. – Zapora będzie składała się z trzech szeregów drutu ostrzowego, który to drut jest wykorzystywany przez wojsko na całym świecie – poinformował wicepremier.

- Znajduje się tam też pozbawiony roślinności pas drogi granicznej.

- Polska już dziś odgrywa w tym procesie kluczową rolę.

- 27 marca w życie weszło rozporządzenie zawieszające prawo do azylu.

- „W zasadzie 95% zapory perymetrycznej na granicy z Kaliningradem, z Królewcem jest już wykonana.

- Budowa tymczasowej zapory rozpoczęła się w środę w okolicy Wisztyńca na granicy Polski z obwodem kaliningradzkim.

Szef MSWiA zachwala ograniczenie prawa do azylu. «Czekaliśmy na to»

Aby móc efektywniej przeciwstawić się nielegalnej migracji rząd przygotował szereg rozwiązań, które pomogą w uszczelnieniu systemu wizowego, uregulowaniu dostępu do azylu i naszego rynku pracy dla cudzoziemców. Jednym z tych rozwiązań jest ustawa, która umożliwi zawieszanie prawa do azylu. Konieczne jest także monitorowanie granicy z Litwą, by nie dopuścić do zmiany tras przerzutowych. Rząd będzie stanowczo reagować na każdy przejaw wspierania nielegalnych działań, również wewnątrz kraju. Premier wezwał do wspólnych działań na poziomie europejskim w odpowiedzi na zagrożenia hybrydowe. Wzmocnienie współpracy z państwami członkowskimi UE i NATO będzie kluczowe dla dalszego zwiększania bezpieczeństwa całego regionu.

Krajów zaprzyjaźnionych, a nad Obwodem Kaliningradzkim zaroiło się od samolotów z Turcji, Białorusi i Syrii. Decyzja Ministerstwa Obrony Narodowej w sprawie budowy nowej zapory ma związek z informacjami o uruchomieniu lotów z Afryki Północnej oraz z Bliskiego Wschodu do Kaliningradu. Federalna Agencja Transportu Lotniczego Rosji poinformowała, że od 1 października udostępnia wszystkim krajom niebo nad Kaliningradem. Pierwszy odcinek tymczasowej zapory powstał w okolicy wsi Bolcie, Żerdziny i Wisztyniec. Zaczyna się kilka metrów od symbolicznego słupa granicznego przy trójstyku granic Polski, Rosji i Litwy.

Szef MON podał, że budową ogrodzenia mają zająć się saperzy, a prace rozpoczną się już w środę. – W związku z tym już dziś rozpoczną się prace podjęte przez saperów żołnierzy Wojska Polskiego w sprawie zbudowania tymczasowej zapory na granicy z Obwodem Kaliningradzkim – poinformował Błaszczak. Budowa tymczasowej zapory rozpoczęła się w środę w okolicy Wisztyńca na granicy Polski z obwodem kaliningradzkim. Zapora o wysokości 2,5 m i szerokości 3 m ma powstać na całej długości granicy z Rosją.

Jesteśmy przygotowani na każdy scenariusz — powiedziała funkcjonariuszka SG. Mariusz Błaszczak nie podał terminu, ale zapewnił, że «prace będą trwały szybko», ponieważ «granica musi być szczelna, żeby Polska była bezpieczna». Budowę rozpoczęto od miejscowości Wisztyniec w gminie Dubeninki. Jak poinformowała PAP rzeczniczka prasowa Warmińsko-Mazurskiego Oddziału Straży Granicznej Mirosława Aleksandrowicz, strażnicy graniczni «cały czas patrolują granicę». Bariera będzie taka sama jak ta, która została skończona na granicy z Białorusią.

Jak budowa zapory wpłynie na Jak wziąć silny ruch cenowy rozwiązanie kryzysu migracyjnego? – Zasieki to jedno, one nawet mi nie przeszkadzają. Inną i zasadniczą kwestią jest, jak będziemy postępować z osobami, które podejmują próbę przekroczenia granicy – mówi «Faktowi» Mariusz Cielma z «Nowej Techniki Wojskowej».